Foreign Company Setup in India

Home / Foreign Company Setup in India

Foreign Company Setup in India

Foreign Company Setup in India

India is one of the fastest-growing economies in the world, offering vast opportunities for foreign companies to expand their operations. Setting up a business in India allows foreign investors to tap into a large consumer base, skilled workforce, and favorable government policies. However, establishing a foreign company in India involves strategic planning, legal procedures, and regulatory compliance under Indian laws.

we provide end-to-end assistance to foreign companies for business setup, regulatory approvals, tax planning, and post-incorporation compliance.

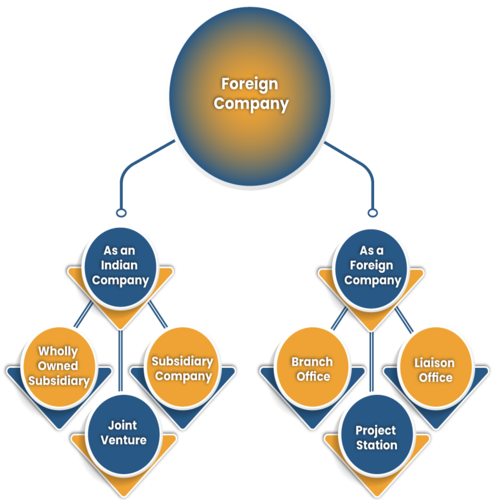

Ways a Foreign Company Can Enter India

Foreign companies can establish their presence in India through any of the following structures:

✅ Wholly Owned Subsidiary (WOS)

A company incorporated in India with 100% shareholding held by a foreign entity. Ideal for complete ownership and control.

✅ Joint Venture (JV) with Indian Partner

A partnership between a foreign company and an Indian entity to collaborate and share ownership.

✅ Liaison Office (LO)

Acts as a communication channel between the foreign company and Indian customers. Cannot undertake commercial or trading activities.

✅ Branch Office (BO)

Set up to carry out permitted business activities in India such as export/import, R&D, consulting, etc.

✅ Project Office (PO)

Established for executing specific projects in India, especially in construction or infrastructure sectors.

Key Advantages of Setting Up a Company in India

✅ Access to a huge and growing consumer market

✅ Skilled and cost-effective workforce

✅ Government initiatives like Make in India, Startup India, PLI schemes

✅ Liberalized FDI norms in most sectors

✅ Tax benefits and incentives in certain sectors and states

✅ Strategic location for serving Asian and Middle Eastern markets

Documents Required (Indicative)

📄 From Foreign Entity:

Certificate of Incorporation

Memorandum & Articles of Association